The British machine tools gap

Out with skills. Just finance equipment spending

Large manufacturers today are, generally speaking, integrators that pool large numbers of contractors together to create a final product. One can see this in U.S. defence procurement. While Northrop Grumman is credited with the creation of the B-2 Spirit stealth bomber, its primary contribution was the initial design, prototyping, and limited manufacturing of key sections, such as the cockpit. The plane’s radars relied on expertise from Hughes Aircraft. Boeing and Vought undertook the bulk of the actual manufacturing. These companies, in turn, relied on hundreds of smaller subcontractors to manufacture and test individual components.

The same applies to electronics companies like Nvidia or Apple: these nominally American companies rely on millions of workers in East Asia. We know about the Foxconn empire (revenues of about £200 billion). Running on millions of workers, hundreds of thousands of robots and razor-thin net profit margins of around 2.5%, it supplies billions of consumer electronic products each year. The Taiwanese giant had a capacity to produce approximately 6.4 billion pieces of equipment per year in 2021. It is only the largest of a whole ecosystem of electronics manufacturing contractors. There’s Wistron, Pegatron, Jabil, Luxshare Precision and Flex to name a few.

Some large manufacturers are more vertically integrated than others. Tesla, renowned for their vertical integration, is actually heavily reliant on foreign expertise. For its battery technology, it relies on Chinese CATL and BYD, as well as Japanese Panasonic and Korean LG. BYD are a more serious example of vertical integration. They make cars, but also the touch screens that go in them. Via their own in-house electronics company, they also build the phones for electronic appliance company Xiaomi and network infrastructure giant Huawei.

Most manufacturing requires the assembly of many thousands of highly variable parts. For aerospace and many other sectors, most components are produced not by large manufacturers, but by thousands of small machine shops, each typically equipped with a handful of machine tools. A vast ecosystem of small machining shops dominates high-mix, low-volume component manufacturing. There are well over 5,000 “job shops” in the U.S.

After metal has been produced in its crude form, a range of machining techniques is needed for primary metal forming. These include forging (pressing down hard), extrusion (pressing things through), and casting (filling a mould with liquid metal). In addition to this, some components can be formed through additive manufacturing (3D printing). Metals can also be bent by being pressed against specific dies.

After the primary shape has been formed into bars, wire, or ingots, the shape is refined through cutting via machine tools. Examples include milling (a rotating cutting tool applied to a metal form), routing, turning, and laser cutting. Metal components can also be welded together through a mixture of pressure and heat. There are also machine tools dedicated to finishing processes, such as sanding.

Manufactured components are highly variable, and therefore, machine tools must be specialised and vary significantly in size and price. Some lathes cost a few thousand dollars, while larger computer numerical control (CNC) machines can be sold for millions of dollars. I will not go into exhaustive detail about the different types of machine tools. My company, Bismarck, has a great introduction. Here is a valuable article on the U.S. machine tool industry, and here is an insightful academic paper on Russia’s acquisition of machine tools for rearmament.

More germane to the discussion is the fact that almost all machine tools are purchased and used by a vast number of small shops. The low volume and high variability of components reduce the likely capacity utilisation of machine tools. For a prominent manufacturer like Jaguar Land Rover, Airbus or Rolls-Royce, buying your own machine tools often means low utilisation.

I spoke with a machine tool company that purchased one of its CNC machines from Rolls-Royce. It previously had only twenty minutes of operating time, despite being operational for years. Utilisation is best maximised by having dedicated machine shops. Because machine tooling is a complicated business with specialised equipment for different components in entirely different sectors, there will be a very large number of relatively small machining operations in any large industrial base.

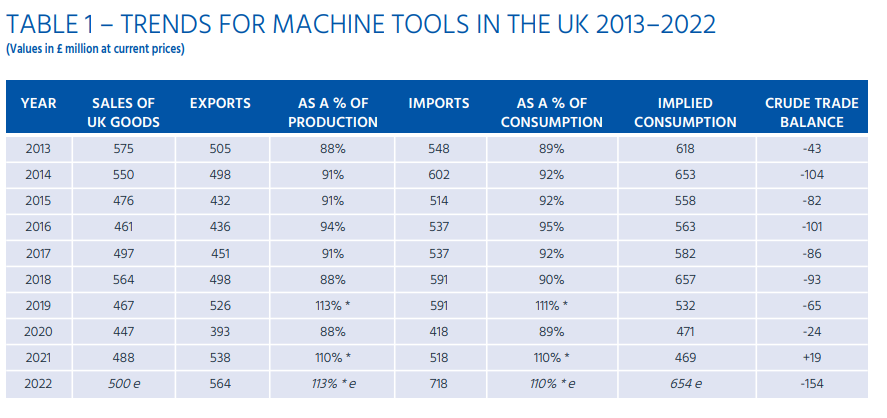

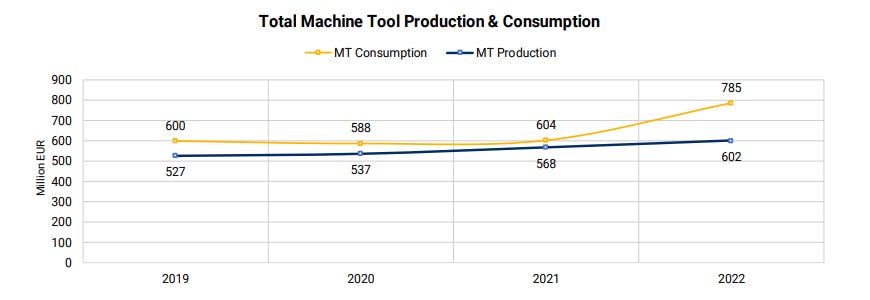

Britain is not actually that deficient in machine tool manufacturing. We consume only a little more than we produce, and the trade balance is not that bad. The main issue is that our machine tool consumption is relatively low.

Figure 1: UK machine tool sales, exports, imports and consumption in £ millions. Source: MTA

Figure 2: UK machine tool production and consumption in euros 2019 to 2022: Source: CECIMO.

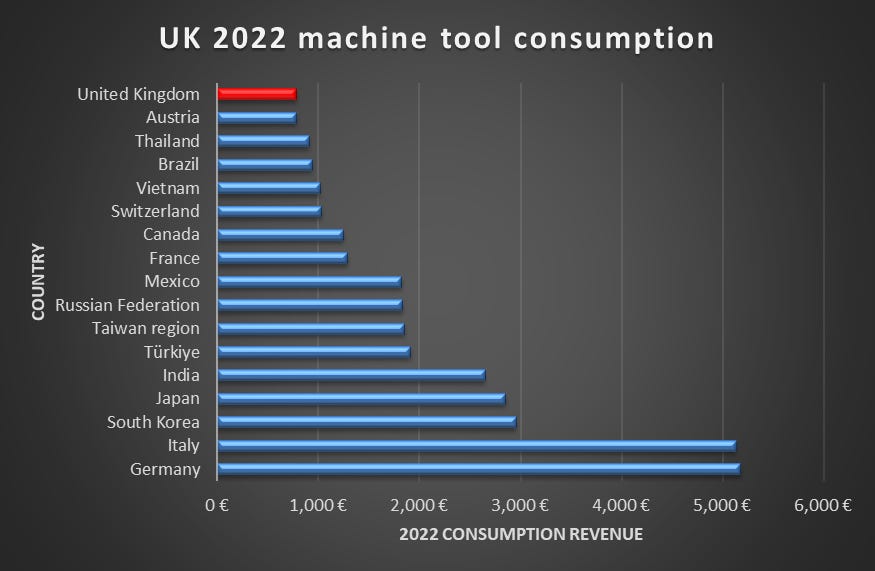

In 2022, British machine tool consumption (in terms of equipment sales) was 3% that of China's, 15% of Germany's, 40% of Taiwan's, 61% of France's, and 63% of Canada's. The latter two are notable because Britain has a larger manufacturing economy than Canada and only a marginally smaller one than France. As can be seen below, Britain’s position in machine tool consumption is similar to our consumption of robotics: small for an industrial base of our size.

Figure 3: UK Machine tool consumption in euros (millions) in 2022. Source: CECIMO.

Much as with robotics, the academic link between machine tool intensity and productivity growth is solid. While Britain is not totally deficient in machine tools, it clearly seems underpowered. This has spillover effects on our productive capacity, from the ability of our manufacturers to meet international orders to our government’s ability to rearm.

There is a potential solution to this: machine tool financing. We already have full expensing for capital equipment, but this is insufficient. The machine shop sector is tilted towards smaller, specialised companies, which often have to take on debt to finance the purchase of machine tools. It is worth considering that many of these shops are small family businesses where the workers are getting quite old. Unless something changes quickly, the sector is likely to decline. Given the discrepancy between British and foreign machine tool consumption, more significant support is needed.

I envision a state-owned corporation for financing machine tools. It will be allocated £5 billion over a parliamentary term (5 years) to provide grants to machine shops to purchase as many CNC machines, lathes, and forge presses as they need. Since machine tool spending is under £1 billion, this would have a significant impact on increasing nameplate manufacturing throughput capacity. It would also move investment and talent into the machining sector. Some spare money could be used to incentivise purchases of British equipment, or to go to export financing.

This may seem dirigiste, but consider that Britain already spends over £60 billion, or 2.7% of GDP, annually on “industrial policy” every year. Most of this is allocated to promoting research and development, as well as “jobs and skills.” This includes £6 billion in grants and £8 billion in loan support. If we are to make room for £1 billion worth of machine tool grants a year, we could move away from broadly subsidising research and development.

I argue that, for productive capacity, subsidising equipment is preferable to trying to foster innovation by subsidising education and vaguely defined research. In today’s world of rampant corporate espionage, open borders and market research, boffin-focused industrial policy has diminishing returns, while having the machining capacity in place to grow quickly is more important than ever.