Firm Power can reduce Britain’s electricity prices

Geothermal and fission-based electricity are the foundation for a British industrial renaissance.

Expensive electricity

Limited access to cheap, dispatchable electricity exacerbates Britain's industrial stagnation. From 2000 to 2021, electricity prices have grown 210%, outstripping wages and general inflation. This is before the recent rises brought on by Russia’s invasion of Ukraine.

Figure 1: Electricity, Source.

The situation is even worse relative to our peers. British electricity prices for industry are higher than those of any comparably rich country. There is a clear correlation between automation and cheap industrial electricity.

Figure 2: Robot density is correlated with cheap electricity. Sources include BEIS and the International Federation of Robotics. More can be read on the energy demands of automation here.

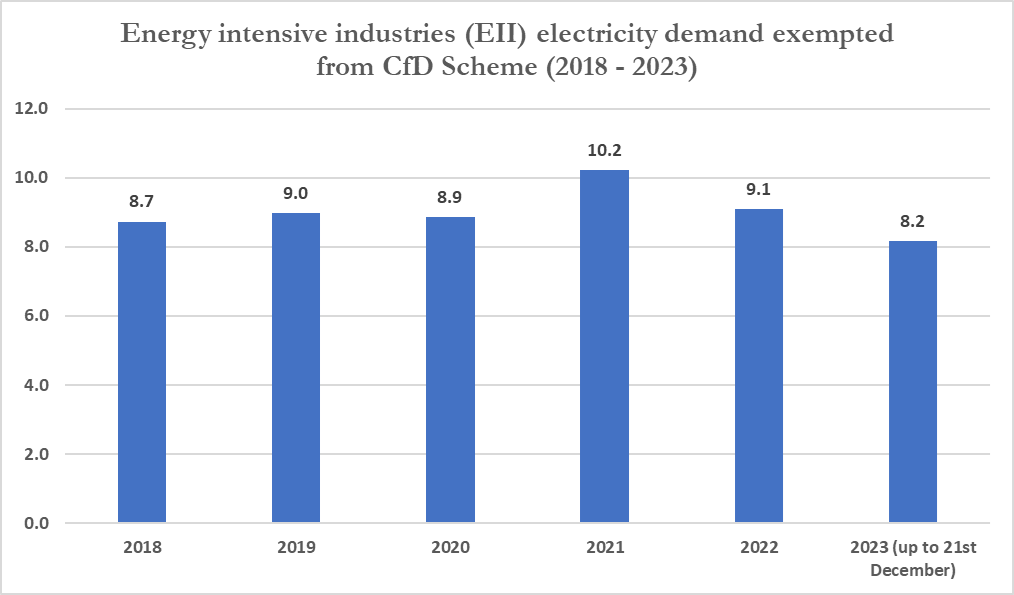

Our production industries, measured by the index of production, are just 95% of what they were in 2019. For the energy sector, it is 68%, while for mining and quarrying it is 67%. Britain's energy-intensive industries have used less electricity in 2023 than any other recent year.

Figure 3: Terawatt-hours of demand for energy-intensive industries exempted from the contracts for difference (CfD) levy from 2017 to 2023.Source.

Though not as affected by energy prices, discrete manufacturing is flat. Even in current prices, motor vehicle and aerospace vehicle sales peaked in 2017 and have not recovered since.

Figure 4: UK sales of motor vehicles, trailers, semi-trailers, and other transport equipment from 2015 to 2022 in £ millions (current prices), Source (ONS).

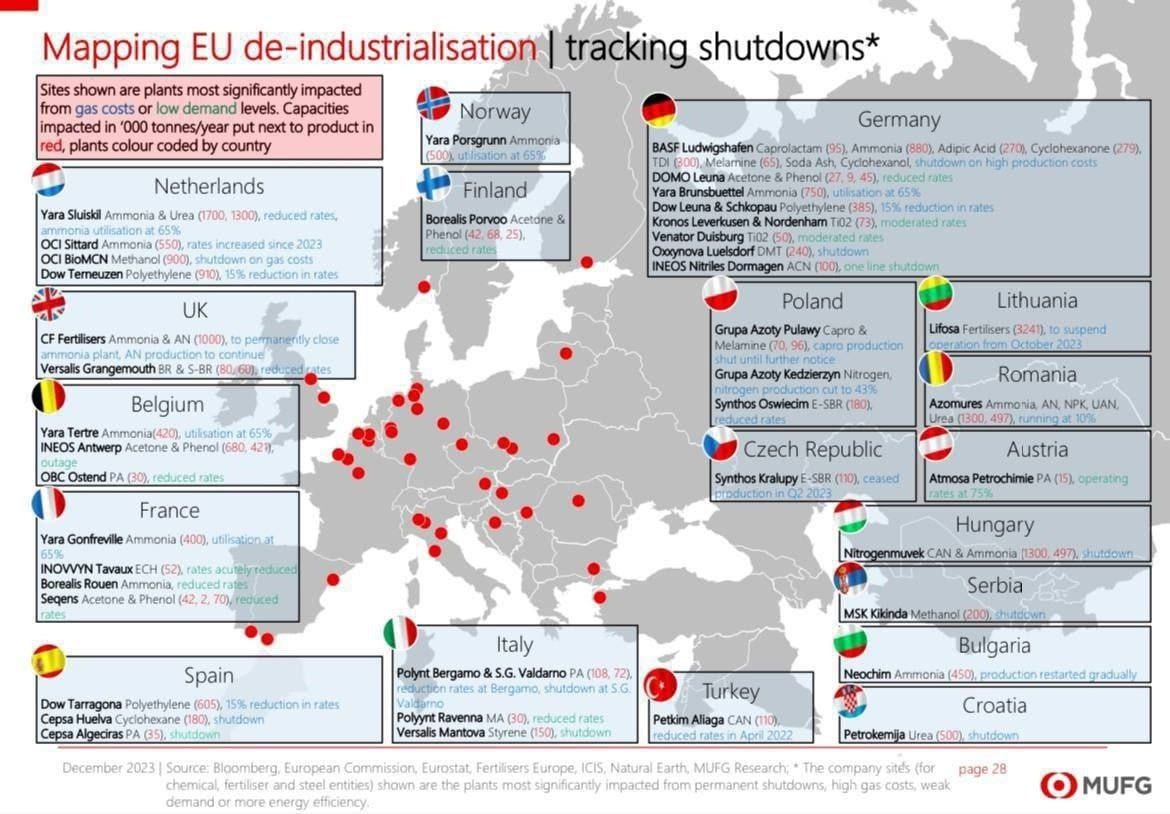

Though undoubtedly affected by trade restrictions imposed by Brexit, the simultaneous poor performance of European manufacturing suggests the more significant issue is the high cost of electricity. The graphic below highlights the rapid shutdown of various industrial sites across Europe.

Figure 5: European factory shutdowns 2023, Source.

This is driven mainly by energy increases. Large German chemical customers have seen electricity prices double from 9 cents per Kwh to 19 cents per Kwh between 2019 and 2022.

In the backdrop of these increases is a marked expansion in variable wind and solar generation. Because factories require predictable, dispatchable generation, an intermittent grid is unsuited for satisfying increasing industrial demand. Hydrogen, the proposed solution to storage by the Royal Society, is prohibitively expensive to store and transport.

If the story of electricity prices from 2022 to 2050 is the same as 2000 to 2021, British industry will suffer. Services, particularly related to AI, will also be constrained. Competing nations like Ireland envisage data centers taking up 23% of all electricity demand by 2030.

Geothermal Electricity

The solution is expanding sufficient zero-carbon firm power to reduce industrial electricity prices. Unlike the idyll of a fully renewable + storage grid, it has already been achieved successfully in Iceland at a limited scale.

With 70% hydroelectric power and 30% geothermal electricity, Iceland has a 100% renewable and carbon-neutral electricity grid. With it, it provides over ten times more electricity per capita than Britain. This bounty has allowed the country of under 400,000 to become the tenth-largest smelter of Aluminium globally, producing more than any EU country in 2022. Electricity is so cheap in Iceland that U.S. producers have shifted production there.

If Iceland, which has to import bauxite for aluminum production, can build a heavy industry out of nothing more than cheap firm power, the potential value of cheap baseload energy to the UK could be seismic.

Figure 6: Iceland and UK per capita electricity generation, Source.

Geothermal electricity has, up until recently, been viewed as location-dependent. The geothermal gradient refers to the temperature increase rate as a hole is drilled. In Iceland, the gradient is very steep. Hence, natural geothermal energy can be sourced relatively cheaply. This is not so in most of the world. The table below shows that variance in the gradient dramatically changes the maximum temperature of a well.

Figure 7: Different geothermal projects. Left axis shows gradient. Right axis shows the depth of the well. Data labels refer to the maximum fluid temperature at the bottom of the well. Source.

Higher temperatures equal greater thermal efficiency and more power potential. If water reaches 374 degrees Celsius and 220 bars of pressure, it becomes supercritical, drastically improving its thermal efficiency. Though such wells have not been commercialized, they represent potentially limitless energy if made accessible globally.

The problem is that for most of the world, to reach such temperatures would require drilling up to 12 miles down, far beyond the capability of mechanical drilling.

Quaise Energy, an American geothermal start-up, proposes using gyrotrons, millimeter-wave emitting machines used in fusion reactors, to vaporize rock with extreme temperatures rather than bore through it. This could allow for drilling depths far beyond today’s limits.

While speculative, if artificial geothermal energy became viable across the world, all questions of energy scarcity would be upended. The earth’s crust holds far more power than all the world’s uranium, thorium, and fossil fuel reserves. While governments and utilities spend trillions of dollars for buildouts of renewables and hydrogen, global capital expenditure for geothermal energy only breached 1 billion dollars in 2021.

Empowering British Nuclear

Any firm power strategy must also consider nuclear fission as key. Prioritizing the two technologies simultaneously makes sense. Nuclear power is proven and maintains critical expertise. Geothermal energy requires little initial cost and has enormous potential payoff.

Regarding large-scale reactors, Britain must rely on foreign suppliers. South Korea’s Kepco is the only viable supplier of large-scale nuclear power. Domestic British excellence exists in small modular reactors (SMRs) via Rolls-Royce. Unfortunately, the SMR competition is slowing down initial work. The Rolls-Royce model is the most advanced in the generic design approval process, and other countries will prioritize their national champions.

One necessary step is to prioritize SMRs and fission over speculative fusion. While fusion is an area of interest, inadequate supply of tritium is a severe bottleneck to commercialization, and no major research venture is tackling this. Any expanded fusion research, to the detriment of fission or geothermal, will likely end in delay and reduce institutional support for all three technologies in the long term.

Recommendations

Geothermal power, alongside existing efforts to rejuvenate nuclear fission, should be prioritized in government subsidies, particularly over hydrogen. Great British Nuclear and an analogous “Great British Geothermal” should be empowered.

The current research spending on geothermal energy by governments is tiny, with the 2022 U.S. infrastructure bill earmarking $84 million for geothermal research over three years. With funding already committed for geothermal heating, even a commitment of £300 million for novel drilling techniques could be transformative.

Britain is a leader in fusion research. Gyrotrons, a potential drilling technology for advanced geothermal, are frequently used in fusion reactors. Efforts should be made to repurpose this technology for drilling.

A government task force should be set up to engage researchers in state-of-the-art geothermal projects, particularly from the U.S. and Iceland. This should be centered around a new drilling project to reach supercritical temperatures in a British well by 2035.

Any commercial generation from new geothermal or SMR-based fission generation should be managed by a new public utility, which will be specifically targeted to energy-intensive industries. This could be a subsidiary of Labour’s proposed Great British Energy. It would supply baseload energy to industrial users rather than households.

The SMR competition should be split up. Rolls-Royce should get its own contract while other entrants compete for a smaller investment.

This blog post has been written as a submission to the TxP Progress Prize run by Civic Future and New Statesman Spotlight, responding to the question of how to get Britain moving again.

What is the effect of the temperature gradient on electricity generation? Is it actually plausible that geothermal could be built in Britain with current technology, or is it more of a hopeful tech, relying on something like the Qaise project coming to fruition?