Direct Reduced Iron - the other way of making steel

Direct reduced iron represents an alternative to blast furnaces in making high quality steel, but is a marginal technology. It is being proposed as a route to decarbonization.

The standard divide in steelmaking techniques is between blast furnaces combined with basic-oxygen furnaces (BOFs) and electric arc furnaces (EAFs). While EAFs use scrap steel, BOFs are integrated with blast furnaces that produce pig iron, which is refined into new steel.

In blast furnaces, iron ore mixes with coking coal, limestone, and hot air. The coke reduces the ore to metallic iron by reacting with the oxygen and turning it into carbon monoxide. One molecule of iron ore reacts with three molecules of carbon monoxide, leaving two iron atoms and three molecules of carbon dioxide.

The result is “pig iron,” a metallic iron processed further into steel. Byproducts include metal oxides, silicon dioxide (slag), and carbon dioxide, which is released into the atmosphere.

The pig iron is then processed into steel when exposed to oxygen in a BOF. Other elements, such as nickel, boron, and chromium, are added to this process to create various steel alloys.

EAFs have been the traditional answer to reducing carbon emissions in the steel industry, and they are an essential technology for recycling used steel. However, EAFs have limitations. Some steel grades will likely always require new steel and the supply chain necessary to supply it.

EAFs are also vulnerable to rises in the price of graphite electrodes, one of their key components. Graphite is chosen as the critical material for heating because it combines high thermal conductivity, high melting point, and good electrical conductivity. An electric current is passed through these electrodes to melt and refine scrap steel in EAFs. China, the dominant market for producing graphite-based products, is the chief producer of most graphite electrodes.

Blast furnace / BOF operations are, therefore, essential for producing new steel, but they are quite dirty. The only alternative for making new steel is the direct reduced iron process (DRI). This creates an alternative to pig iron that can be used in EAFs, blast furnaces, or BOFs.

In a DRI process, iron ore pellets are fed into a reactor. Here, they are reduced by a synthetic gas created by mixing natural gas with high-temperature steam. This produces hydrogen, which reduces the oxygen content of the iron ore. As a byproduct of the synthetic gas, carbon monoxide is released but does not play an essential role in the process. Currently, over 90% of DRI is produced using natural gas. However, coal can also be used as a reducing agent. To reduce carbon emissions, attempts have been made to replace natural gas with pure hydrogen as the primary reducing agent.

Unlike in blast furnaces, DRI techniques do not require the melting of the iron, meaning lower temperatures. This reduces the oxygen content of the iron ore into iron, which is then pressed into hot briquettes of iron or left to cool into cold briquettes. DRI is a critical component in feeding the growing number of arc furnaces since high-quality scrap steel is a limited resource.

Blending DRI with scrap steel can improve the steel quality produced by EAFs. Where scrap supply is poor or non-existent, local DRI plants can provide a substitute feedstock. The purity of existing scrap steel is declining, and DRI-based iron is required to dilute impure elements such as copper and zinc to improve the final product quality.

Pig iron from blast furnaces has several advantages over DRI, namely higher metallic iron content, lower impurities, lower melting point, and higher carbon content. The amount of electricity required is also lower. For this, among other reasons, DRI has not displaced the blast furnace as the primary producer of metallic iron since its introduction in the 1960s. DRI production was 110 million tons in 2022, while for traditionally made pig iron, it was 1.28 billion tons.

Figure 1: 2022 Blast furnace vs DRI market share method. Source.

DRI’s benefits over the blast furnace include a smaller capital investment and no need for coking coal, meaning lower emissions. As long as the primary fuel, natural gas or coal, is abundant and cheap, the product’s price is lower, albeit the resulting iron is less desirable than pig iron.

There are three categories of DRI: cold DRI (CDRI), hot DRI (HDRI), and hot briquetted iron (HBI). They are generally all used in EAFs, although HBI can be used in blast furnaces to increase hot metal production and lower coke consumption. HBI can also be mixed with pig iron in a BOF.

The vast majority of DRI produced is CDRI, which is the lowest quality. Hot direct reduced iron (HDRI) has to be fed directly to nearby EAFs for energy savings and to improve productivity by taking advantage of its high temperature. It has to be transported via a specialized conveyance system.

Picture 1: Cold direct reduced iron.

Picture 2: Hot transport conveyance for hot direct reduced iron

Hot Briquetted Iron (HBI) is heated to higher temperatures above 650 degrees Celsius and is particularly dense, having a density greater than 5,000 kilograms per cubic meter (5,000 kg/m3). It can be used in EAFs, BOFs, and blast furnaces and is of higher value than CDRI and HDRI, which are only used in EAFs.

Picture 3: Hot Briquetted Iron

As can be seen below, the majority of DRI produced is CDRI. When it comes to exports, a more significant proportion is HBI.

Figure 2: World DRI production by year. Source: Midrex.

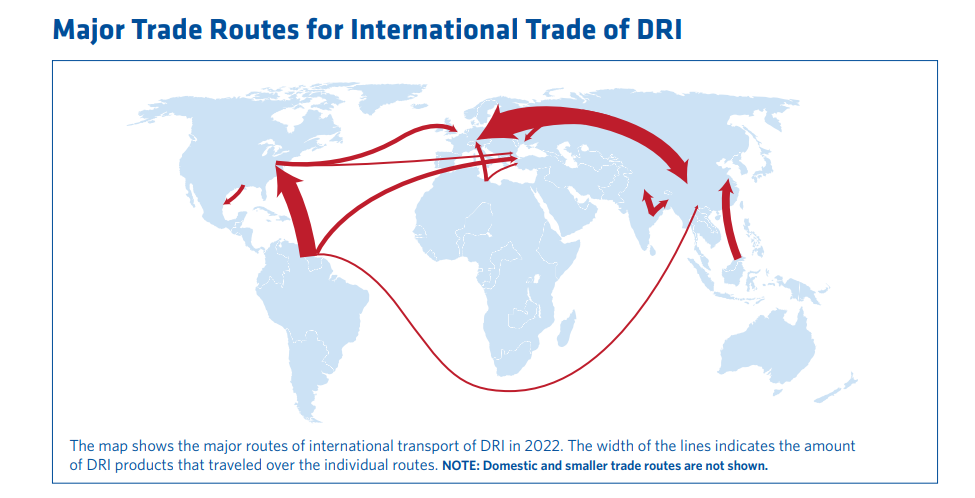

A great deal of DRI is exported, nearly 25%. It is heavily imported by the U.S., Europe, and China and supplements their EAFs. A rough illustration of the trade flows can be seen here.

Figure 3: DRI trade flows. Source: Midrex.

Given the relative increase in EAFs versus BOF and the reliance developed countries have on potentially problematic DRI exporters like Russia, there is potentially a demand for more domestic DRI production.

DRI is primarily an Asian phenomenon

DRI is used extensively where natural gas prices are low, like in the Middle East. In areas with cheap coal access, like India, DRI is popular.

The majority of production comes from just two countries: India and Iran. China, the largest steel producer worldwide, has no capacity for this, and Germany possesses only minimal capacity in Europe. Both India and Iran rely on EAFs for a majority of their production.

Figure 4: DRI 2021 production by country (%) Source

While limited in the developed world, Large steel manufacturers everywhere will need HBI if they add EAFs to their plants to decarbonize. Voestalpine is Austria’s primary steel manufacturer. It plans to replace two of its five BOFs with EAFs over the decade. It has a 20% stake in Arcelor Mittal’s HBI furnace in Corpus Christi, Texas, which it originally built. This provides the HBI it needs to make high-quality steel in EAFs. Some of the iron made here was used to manufacture the Nord Stream 2 pipeline.

DRI Processes

Around 60% of DRI production is based on the “Midrex” process, named after the U.S. company Midrex. Since 1969, nearly 100 Midrex shaft furnaces have been built in 21 countries. The company was started in the 1960s by the American engineer Donald Beggs, a manager at the steel components manufacturer Midland-Ross Corporation. The Midrex process opened the door to create steel with fewer inputs and was bought by the Korf group – subsequently moving to North Carolina. In 1983, it was purchased by the Japanese steel giant Kobe Steel, which owns and licenses the process to this day.

The second largest process for DRI is the use of rotary kilns in India, which, instead of natural gas, generally relies on non-coking coal for reduction. Coal is more plentiful and easily transportable than natural gas, and so for large coal users like India, it is ideal. Rotary kiln processes are varied and owned by various companies, from Indian steelmaker Jindal to the Finnish company Metso Outotec.

Two other notable processes operate similarly to Midrex. The TYL/ Energiron process is co-developed by the Italian firms Tonova and Danielli and is popular in Mexico, the UAE, and the U.S..

PERED, or the Persian reduction process, is relatively new and only began production in 2018. The Iranian government licensed it through Mines and Metals Engineering GmbH, an Iranian engineering company registered in Germany. It was set up as early as 1996 and is ultimately controlled by Iranian Mines & Mining Industries Development & Renovation, known as IMIDRO, an Iranian state-owned holding company. This provides Iran’s government access to high-end steel to complement scrap steel that it needs to feed its EAFs. Iran is the tenth-largest producer of steel but relies almost entirely on EAFs. DRI is, therefore, necessary for providing Iran with a secure supply of virgin steel.

Figure 5: Process marketshare for DRI, Source: Midrex.

Hydrogen-DRI eats electricity

The transition from blast furnace iron to direct reduced iron was predicted as far back as the 1970s. While it is gaining relevance with the gradual shift to EAFs, it is still a fraction of the size of traditional steelmaking. This could change depending on how determined steel manufacturers and governments are to decarbonize steel production through hydrogen fully.

Realistically, hydrogen-based routes for steel decarbonization rest on direct-reduction iron. Utilizing hydrogen in the standard basic oxygen furnace can reduce emissions by just 21%. For BOFs, hydrogen can only be an auxiliary reducing agent alongside other elements like coking coal, while DRI can be the sole reducing agent. However, for DRI, hydrogen is already used via natural gas and steam.

Theoretically, rather than using natural gas that produces both hydrogen and carbon monoxide, producers can reduce iron purely with hydrogen. This would eliminate carbon emissions. Of 81 tracked ‘green steel projects,’ 56 are related to hydrogen-based DRI or hydrogen production.

The best-known pilot for hydrogen-based DRI is the Hybrit project developed by the Swedish steelmaker SSAB. H2 Green Steel, another Swedish company focused on hydrogen DRI, has disclosed that its steel will come at a 25% premium. The UK is pursuing H2 DRI through the Zero Carbon Humber industrial cluster, which is ‘supposed’ to be up and running by 2040.

Despite its promise, there are significant operational issues with hydrogen-based DRI. This is beyond the scope of this article but can be read in further detail here. As with anything related to hydrogen, the process requires significant amounts of cheap, reliable electricity to make the hydrogen, which must be stored in capital-intensive infrastructure. Hydrogen is produced through electrolysis. It inevitably takes more energy to produce hydrogen than the resultant hydrogen stored. Under one estimate, hydrogen-based DRI consumes 15 times more electricity than a blast furnace for the equivalent amount of iron.

Such usage effectively makes steel manufacturing as energy-intensive as modern aluminium smelting, a significant step backwards in purely technological terms but potentially a step forward in reducing carbon emissions.

DRI plants in Britain? Do not hold your breath.

Where is Britain left here? Carbon taxes and rocketing energy prices have meant Chinese-owned British Steel is announcing the closure of its Scunthorpe-based blast furnace. Indian-owned Tata Steel UK will close its two blast furnaces at Port Talbot. These closures will axe 5,000 in total. Both companies are receiving handouts worth hundreds of millions from the British government to build arc furnaces. This means Britain, for the first time in living memory, will not have the capacity to make pig iron, a competency nearly every significant developed and developing economy has.

Scrap steel used in EAFs can make specific steel grades but not the highest quality needed for automotive or defence-related applications. The chances of blast furnaces returning under a Tory or Labour government are near zero due to high electricity prices, carbon taxes, and subsidies tied to decarbonization. This decline in capability has next to zero effect on global emissions, as Britain will need to import pig iron from elsewhere.

The only potential way to regain the capacity to make new steel will be DRI. The demands of Net Zero necessitate that it be hydrogen-based. Naturally, government subsidies to Tata and “British Steel” are not contingent on investing in the hydrogen-DRI.

A shift to Hydrogen-based DRI would increase electricity demand and cost significantly more than the steel from our retiring blast furnaces, with a slight reduction in carbon emissions as the payoff. This is assuming they are built. The likely outcome is that Britain will become a pure importer of pig iron and DRI. This stands as another footnote in the decline of Britain as an industrial society.

Thanks for that double-barrelled industrio-political post!

The US, though its existing forces are large, well armed and mobile, is no longer a superpower for the same reason. It lacks the industrial – and even technical – base to sustain an industrial war with either Russia or China.