2021 robot orders: China and Britain stand out for different reasons.

The IFR's figures for 2021 show a bumper year.

This will be a bare-bones post. The International Federation of Robotics (IFR) annually releases shipments for industrial robots by country. The latest figures, covering 2021, show a big uptake in orders. Global installations leaped from a two-year hiatus to 517,000 units.

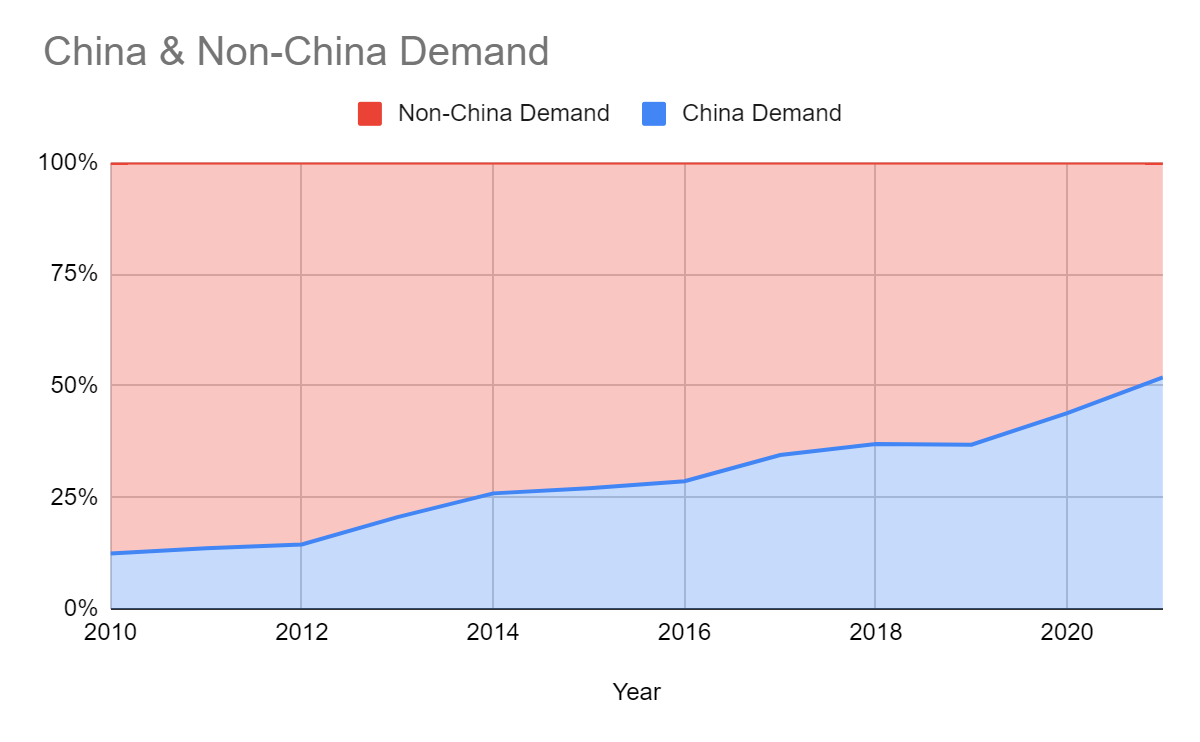

Most of these installations go to Asia — 74% in fact. The trend at the moment is toward this market taking up more of the robot industry’s orders. The big story is China. Its demand grew by 51%. The table below gives an indication of the country’s outsize role in demand.

Looking back, it is worth noting China’s growing share of the market. For the first time, Chinese demand is now a majority of global demand at 52%.

Much of this is imported from the big Industrial robot vendors. These include Japanese FANUC, Yaskawa Motoman, Kawasaki, and Denso. There is also German Kuka (owned by Chinese conglomerate Midea Group) ABB, a Swedish-Swiss industrial giant part-owned by the influential Wallenberg family, Swiss Staubli, and Danish Universal Robots (owned by U.S. testing equipment developer Teradyne). But domestic developers are keeping pace with skyrocketing demand and increasing their actual shipments dramatically. This is not the progress the CCP wanted (which was 50% by 2020), but actual domestic shipments still increased from 20,000 in 2015 to 84,000 in 2021. Targets can be useful even when they are not reached.

There are Asian markets outside China.

Japan: Biggest producer, exporter, and second biggest buyer. It also has the second-largest stock at 390,000. 2021 growth rate is healthy at 21%.

South Korea: Highest density of robots per worker. Fourth-largest buyer. Third largest stock of 366,000. The stagnant rate for 2021 at 2%. Might be taking a breather after decades of relentless investment. Long-term is still a huge market.

India: low number of shipments at 5,000 for 2021. It has the buyers, but likely not the network of distributors and integrators to scale up like China. Look for China-esque numbers in 20 years.

Then there is Europe, which saw a record year of demand at 84,000 shipments. Most of the continent’s demand is taken up by Germany (28%), Italy (17%), and France (7%). Italy’s growth for 2021 stands out at 64%. This was largely down to companies buying before a reduction of tax credits in 2022. Europe’s market is mature and is declining as a share of world demand. The company ecosystem is world-class but increasingly owned by Chinese (Kuka) and American (Universal robots) entities.

The UK is the real outlier in this industry. Despite having a manufacturing sector comparable in size to France and a good-sized economy overall, it has tiny capital investment in automation. Installations were down by 7% to 2,054 units. The UK has very little electronics manufacturing, which is the biggest draw for robot orders. But it does still have a car industry, and automotive vendors were historically the best positioned to invest in robots. Out hostile CAPEX environment might deter investment, but this alone cannot be determinative. This is an exceptionalism Britain can afford to lose.

It was a fairly weak year for the U.S. as well. While its figures rebounded to 35,000, this is lower than its peak of 40,000 in 2018. This is in part due to declining investment from the U.S. automotive industry — which was historically the big buyer. This is being offset by higher growth in markets like machinery, chemicals, and food products. The U.S. has weaker demographic pressures than Europe or East Asia, and being hyper-competitive in international trade is less of a deal for the U.S. in general. Nevertheless, it is notable the country where most of the breakthroughs happen cannot translate this into leading deployments. The U.S. is comfortably third in annual shipments and fourth in total robots. I would still expect it to take the second spot for both categories in the next 10 years, but investment seems a little sluggish.

On a final note, collaborative robots (cobots) are taking up a slightly larger share of overall installations. These are smaller, force-reduced robots that are built to operate without the need for fences or safety barriers. From 2017 to 2021, the number of annual shipments has more than tripled from 11,000 to 39,000. Their appeal is accessibility and deployability. Though marginal at present, they do promise a more accessible form of robotics.

That is all.

Cos are definitely the disruptive option at this point.